Essentially, your client would pay the transaction fees instead of you. Whether you operate as a freelancer or small business, billable expenses are costs you contractually pass on to the client (normally by including them in the final invoice). Perhaps the best way to offset PayPal fees for receiving money is by passing them on as a billable expense. Here are just a few of these methods, as well as why you should or should not use them: 1. But as a small freelancer or entrepreneur, these fees can feel like a major hit to your income.įortunately, there are several ways to cut down on PayPal fees. 5 Ways to Avoid or Decrease Your PayPal Fees for Receiving MoneyĬharging fees to receive payment isn’t unique to PayPal.Įven brick-and-mortar retailers that accept credit cards have to pay a percentage to Visa, Mastercard, American Express, and others each time a customer uses one of these cards. But when it comes to offering a quick and easy-to-use system for your clients, PayPal is one of the best options around. No payment processing service is 100 percent perfect. PayPal charges less than many other payment services.You can set up an account for yourself within minutes.Your clients don’t need an existing PayPal account to make payments.Your clients can make (almost) instant payments.However, many benefits come along with these fees: But before PayPal and services like invoicely, creating, sending, and settling work invoices was a much different experience.Īt first, you might look at the fees PayPal takes from your incoming payments and feel discouraged or even cheated. If you’re new to freelancing or entrepreneurship, online payments might be the only method you know.

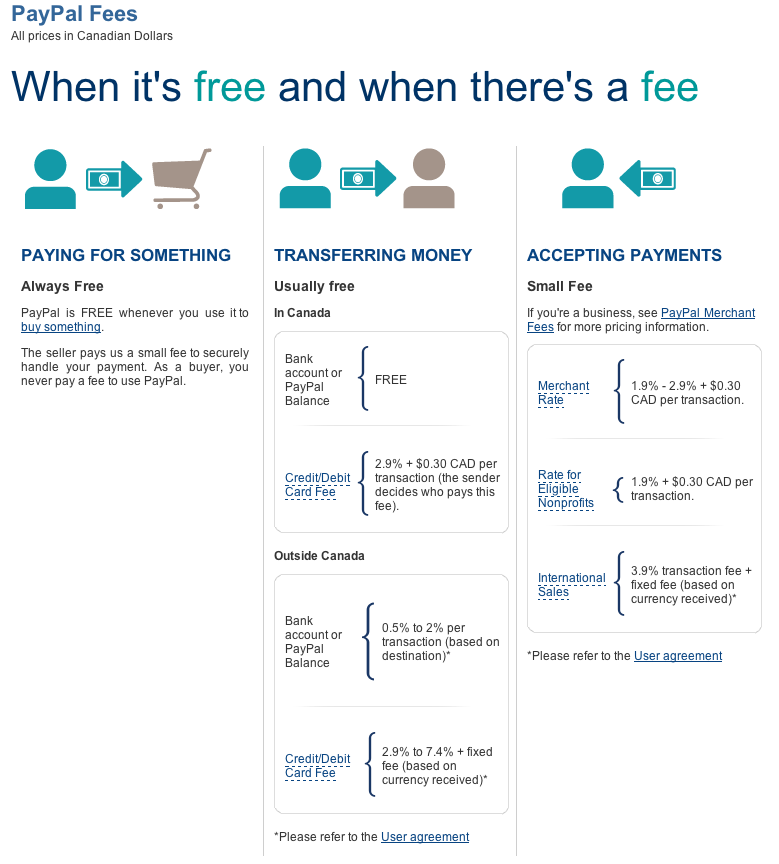

Why Freelancers and Entrepreneurs Should Accept PayPal 4.4% if your client’s bank account is outside the U.S.Īs you can see, these variable fees take out a far larger chunk of your income than the fixed fees applied to each transaction.2.9% if your client’s bank account is within the U.S.and are accepting online payments, your fee percentage would be: Online transactions are also subject to higher fees than in-person transactions.Īssuming that you’re located within the U.S. This percentage will vary depending on the location of your and your client’s bank accounts. On top of this fixed-rate fee, PayPal also charges a percentage of each transaction’s total. Some of the most popular currencies and their respective fees include: This fee will vary depending on the transaction’s currency. To start, PayPal applies a fixed-rate fee to each applicable transaction. So how much should you expect to pay each time you receive money through PayPal? And in most cases, these fees are charged to the person or company receiving the money. To do this, PayPal charges a fee for most transactions that go through its system. To stay in business, the company needs to make some form of income off of its services. Of course, PayPal doesn’t operate out of the goodness of its heart. Unfortunately, this convenient service also comes with some fees: PayPal fee structure But as a freelancer or entrepreneur, your life would be a whole lot more difficult without this payment processing service. Since PayPal has been around for so long, many people take this service for granted. Not only does this mean your financial information stays private, but it also means you have support if something goes wrong with the transaction. Instead of giving your bank account information directly to a company or individual, PayPal acts as a secure third-party. In fact, it’s hard to remember a time when you couldn’t just click a button and send money to a friend, family member, or merchant. What Is PayPal?Īfter over 20 years in business, PayPal and e-commerce pretty much go hand-in-hand. So are you doomed to pay out every time a client settles their invoice through PayPal? To an extent, yes.īut there are also several ways to decrease your PayPal fees for receiving money. Plus, when it comes time to request payment from a client, you want to offer them a payment method they already recognize and trust. You might even be tempted to ditch PayPal altogether for something with fewer fees.īut there’s a reason PayPal reigns supreme in the world of online payment processing.Īfter all, nothing is quite as convenient as a web-based payment portal that links directly to your bank account.

It’s true that paying out a percentage of your income to get your money in the first place is a pain. However, many freelancers and entrepreneurs are less than thrilled about paying numerous PayPal fees for receiving money from clients. Of these services, none is more popular than PayPal. It’s hard to imagine what life was like for freelancers and entrepreneurs before online payment processing came along.

0 kommentar(er)

0 kommentar(er)